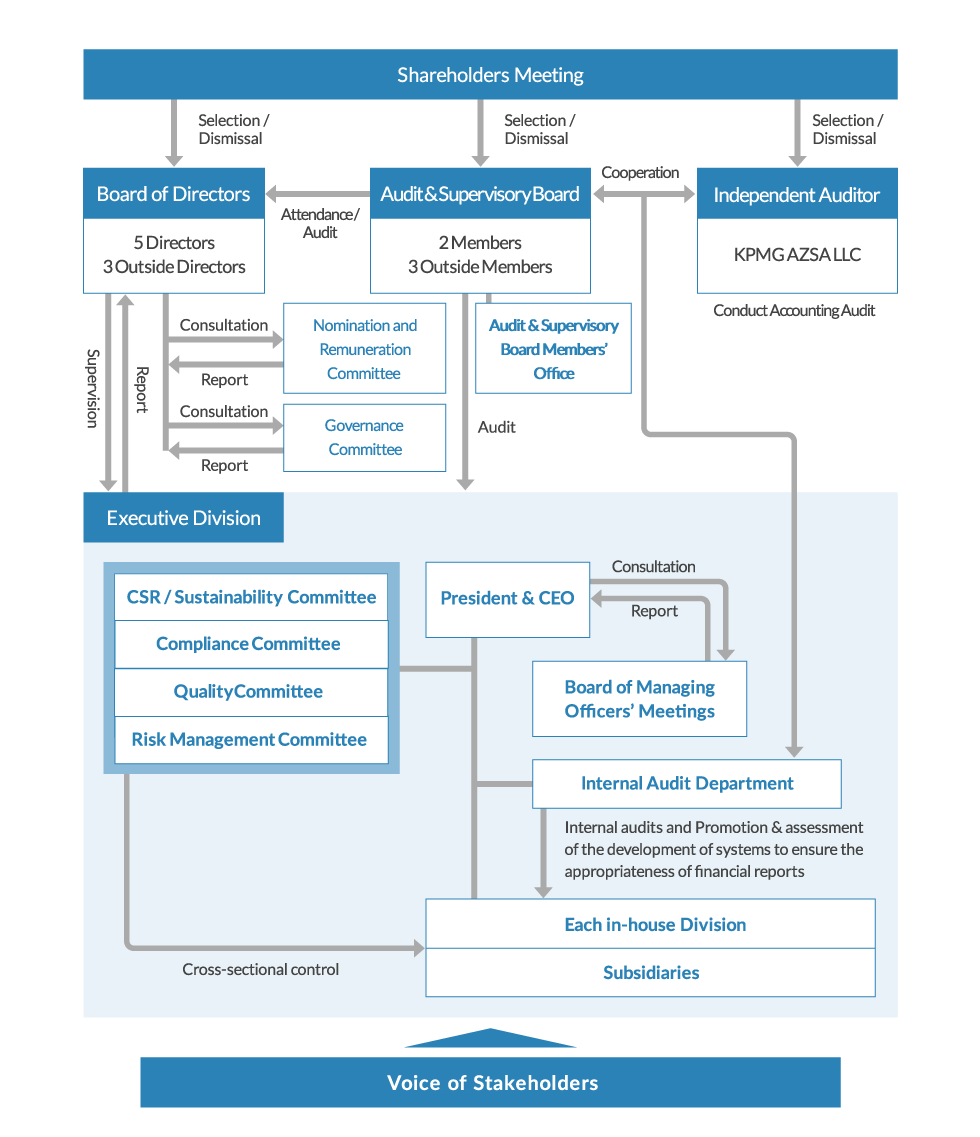

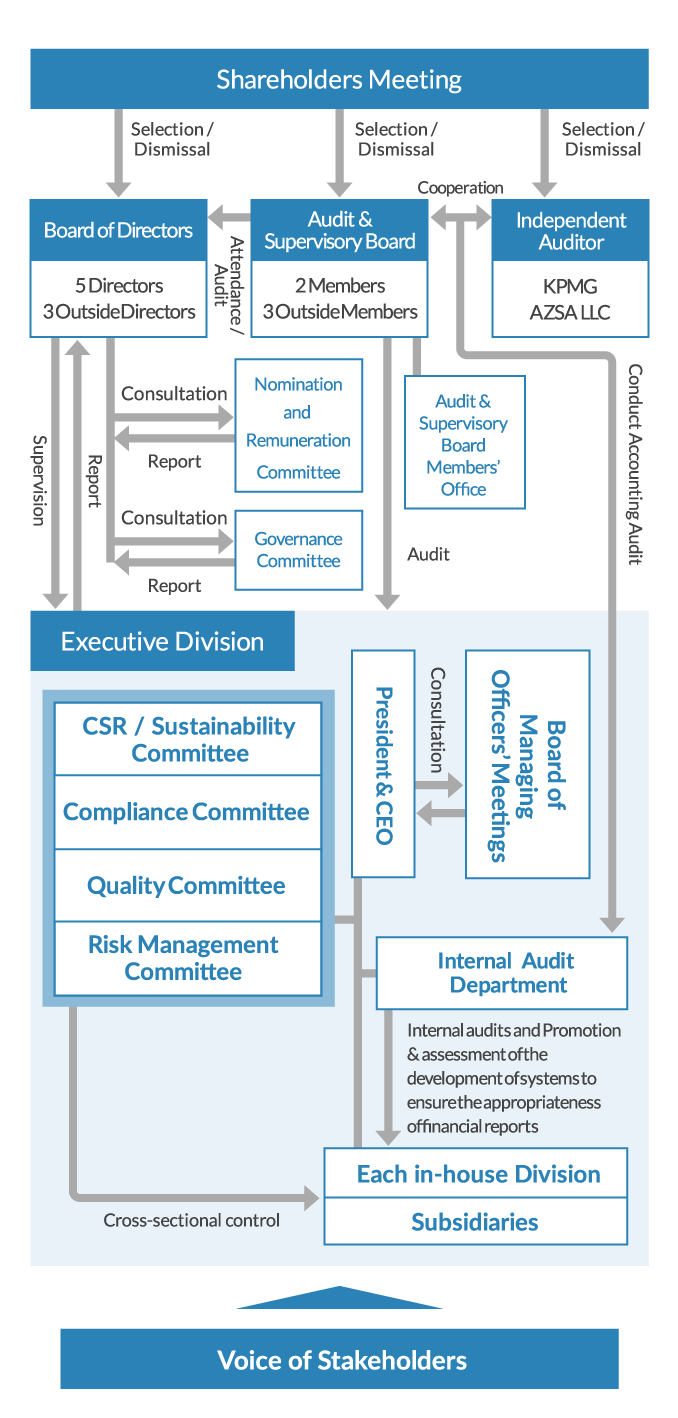

Our corporate governance recognizes the responsibilities we have toward all of our stakeholders, and aims to achieve sustainable growth and increased medium to long-term corporate value through efficient and sound management based on the Sumitomo Spirit—to accord "Banji-nissei*1", "Shinyo-kakujitsu*2", and "Fusu-furi*3".

*1: Do your sincere best, not only in business, but also in every aspect of your life.

*2: Place importance on integrity and sound management.

*3: Do not act rashly or carelessly in pursuit of easy gains.

(As of June 28, 2024)

The Compliance Committee, chaired by a Director and Senior Managing Executive Officer, supervises the Sumitomo Riko Group's compliance activities and promotes various measures important to the Company in an organized and systematic manner. In addition, under the supervision of each department head serving as compliance officer and subsidiary representatives, manager-level compliance leaders promote compliance activities at their workplaces. There are in-house and external (law firm) points of contact that receive compliance-related inquiries and reports from employees and other stakeholders. There are also dedicated theme-specific (harassment issues, etc.) points of contacts for consultation.

In line with globalization of the business environment and expansion of the scope of business owing to entry to new business fields, Sumitomo Riko is exposed to diverse business risks and such risks require sophisticated management. In these circumstances, we have systems for collecting information from internal departments and Group companies in place in order to identify risks throughout the Group. We strive to minimize the impact of risks on business operations by identifying risks to be managed and ways of handling such risks based on risk analysis and assessment with the aim of reducing capital costs and enhancing corporate value.

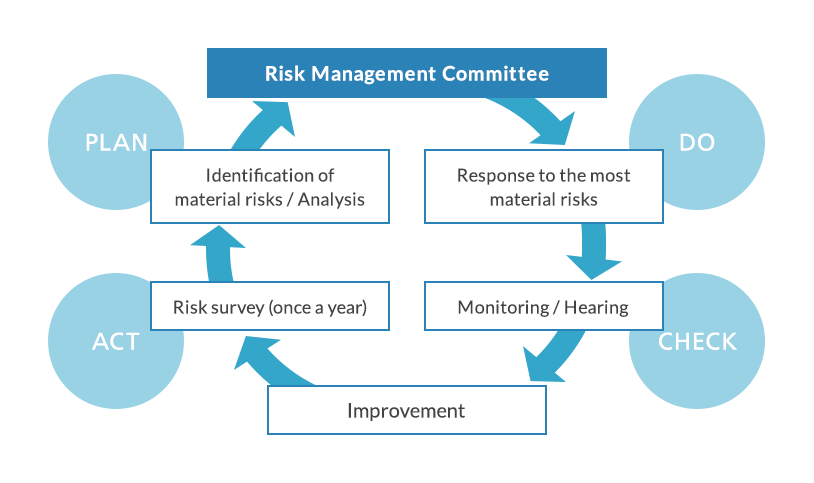

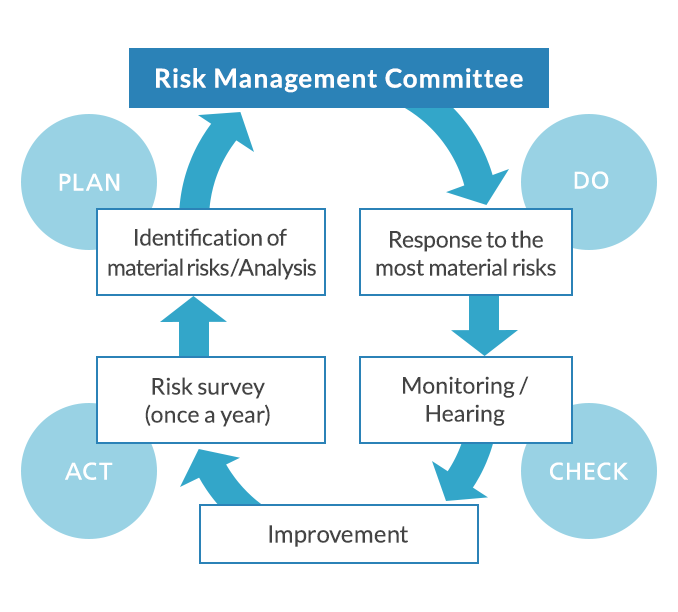

"For implementation of risk management, Sumitomo Riko has established the Risk Management Committee, chaired by the President, and the Risk Management Center, an organization dedicated to risk management, which serves as the secretariat of the Risk Management Committee. The Risk Management Committee supervises and promotes the Company’s risk management in accordance with the Basic Regulations on Risk Management, including periodic surveys of potential risks."

The Risk Management Center serves as the Risk Management Committee’s administrative organization. In ordinary times, the Center 1) formulates, maintains, and operates prevention, preparedness, and damage mitigation measures for earthquakes and other natural disasters and plant explosions and other accidents as well as business continuity plans (BCP); 2) conducts Group risk surveys and assessments, monitors risks, and raises risk awareness; and 3) implements prevention measures and damage mitigation measures such as preparation of guidelines and manuals for use in the event a crisis occurs.

In times of emergency, the Center 1) gives instructions for the initial response and division of roles among the divisions in charge, and 2) gathers crisis information, ascertains impacts, and establishes a crisis response headquarters as necessary. The Center also acts as a contact point for the Group’s crisis issues on a 24/7 basis.

In order to deal with a crisis that may jeopardize business continuity, Sumitomo Riko has formulated Crisis Management Guidelines in which lines of communication, responsible organizations, and initial responses are described so that integrated action can be taken as a Group.

The Guidelines also indicate risk items for which “safety and security information” (it is safe, there is no danger, there is no need to worry, or there is no problem) should be disseminated. Swift information sharing in the Group is promoted even if an incident does not develop into a crisis.

As the Company’s operations extend to over 20 countries, in order to deal with all the potential risks to which the Company is exposed, Sumitomo Riko has identified 14 risk categories, which are classified into 56 subcategories. Organizations responsible for individual risk items are determined to deal with each risk. Having assessed these risks based on the “probability of an event taking place” and the “impact of an event”, we have created a risk map to visualize the degree of impact on business operations. We also review whether responsible departments are implementing effective risk management.

To manage country-specific risks, we conduct surveys of potential risks of our Group companies in Japan and abroad and check their implementation of countermeasures. In these surveys, based on risk items extracted by Sumitomo Riko, risks identified by each site and the site’s response to such risks are assessed. Major risks recognized as a result of the assessment are shared throughout the Group, and in order to strengthen global risk management, we implement measures that prevent risks from materializing. The Risk Management Committee is taking the initiative in establishing a system for implementing a PDCA cycle for continuous improvement of risk management throughout the Sumitomo Riko Group.